Company News: Salaries & Market Reports

“There is no sense of slash and burn. But there is a strong sense of trim and singe.”

The quote is from a transcript of a speech given by Andrew Haldane (Chief Economist at the BofE) last month in Port Talbot, Wales. Whilst the main topic of the speech is very much about monetary policy and measurements of wealth / well being in the UK, the above quote echo’s what I think the City has been feeling since Brexit… Are companies’ indefinitely holding off making “lumpy decisions”?

The full report: http://www.bankofengland.co.uk/publications/Documents/speeches/2016/speech916.pdf

Company News: Salaries & Market Reports

Small banks benefit from Brexit

In a recent article by Compliancy Services according to the Chairman of the UK Treasury Committee, smaller banks could benefit from post-Brexit regulations…

Discussing challenger banks, Andrew Tyrie cities that the chance of easing regulation away from the current “one size fits all” approach to Banking regs by the EU, could benefit small banks

In other positive news for small banks – The UK’s recently appointed head of BofE supervision, Sam Woods of the Treasury Select Committee confirmed he is committed to serving the needs of challenger banks.

The full articel can be found here. http://www.compliancy-services.co.uk/news/article/4644/smaller-banks-could-benefit-from-post-brexit-regulations-easing=newsletter?utm_source=&utm_medium=email&utm_campaign=august16-1-jr

Company News: Salaries & Market Reports

Accessing EU talent after Brexit

Accessing EU talent after Brexit

The Immigration Act 2016 imposes a charge on immigration skills due to be introduced in April 2017, but could now be brought forward following the result of Brexit.

Without exemptions for EU nationals free movement, UK companies will need to use the points based Tier 2 system of sponsorship to recruit from the EU. Any one in HR ops who has supported tier two visas knows that there is a cost and risk associated with it. Analysis from law firm Simpson Millar shows that the total cost for recruiting workers from overseas might actually hit £3,000 or more.

Mariano Mamertino, an economist at one of the UK’s largest job boards Indeed, sums up “June’s official unemployment figures showed the jobless total reducing slightly, but the UK economy’s rate of job creation is fragile at best. In the longer term, crucial decisions will need to be made about what sort of labour market we want in Britain. UK employers have benefitted from the ability to recruit talent from overseas, and many Britons have seized the opportunity to live and work in other EU countries.”

It’s unlikely the door will close on the English Channel, the free movement of workers has obvious economic benefits. British businesses will need to be able to access the talent required to fill vacancies and Europe has been a big part of that source of talent.

European Outflow – gauging intention

In June this year there were 2400 searches on google for ‘permanent uk residency’ – up 5 x on May and almost 10 x on April. The upsurge in leaving the UK over recent months is not dissimilar. Despite Increasing interest in people looking to gain UK permanent residency status and preparing for a move out of Britain, I’m surprised that these search figures aren’t higher considering the ONS reports that there are 3.3M EU citizens in the UK.

Brexit to Frexit – will EU nationals move?

Talking to a senior professional Auditor based in the city, she points out that “the City’s infrastructure to support banking staff compared to other locations is immense. The city has got a lot going for it, over and above Ireland or Paris. I certainly don’t want to move, I moved to London because that’s where I want my job and my social life.”

Political Risk

Whilst Britain has been consumed by Brexit if we turn our eyes to the rest of Europe, the political and economic landscape for some is also uncertain – Italy are in the midst of a banking crisis and a call to exit the Euro (not Europe), a French election coming up in 2017 where the potential of Frexit is already being discussed.

From an investors perspective it is certain that political risk will be a bigger factor in investment decisions than it has been in previous years and Britain isn’t the only European city presenting political risk. Considering that US multinational corporations make up a large part of London’s capital market investors and if today’s Cable rates are maintained, it could be that London keeps its status as the European capital of secondary market trading.

London has a large sustainable supporting infrastructure with an immense amount of talent possessing a forward thinking outlook. After all, London’s providence as the European financial services capital enabled it to become the centre of Chinese renminbi trading despite Brexit woes.

You can bet that city lobbyists will be working overtime to maintain London’s status as a Global and European financial services hub and to maintain its plethora of European bankers.

Company News: Salaries & Market Reports

Internal Audit post Brexit…. Which jobs will stay?

Stephen Gandel reported on Fortune.com that before Brexit there were 40,000-jobs at risk.

Financial Services firms have already started re-locating jobs (mainly euroclear) to Dublin as part of their post Brexit plans. BUT despite the early fears no head office functions have moved.

What the Banks have been saying…

Martin Arnold and Laura Noonan reported in the London FT, that Jamie Dimon, JPMorgan chief executive, warned that 4,000 jobs of its 16,000 in the UK could be moved out of the UK. CEO Jamie Dimon lowered that figure, saying the bank is likely to take at least 1,000 jobs out of London, though the bank is committed to keeping a large staff in the city”. Daniel Pinto — whose IB unit employs most of the 6,000 staff in Britain — also said he hoped to keep most of its UK investment bank intact. The bank would “need to figure out a way to deal with” some specific products and services, such as global custody and corporate deposits, but he said any moves would be gradual.

It has been reported pre Brexit that Morgan Stanley may relocate as many as 2000. There’s speculation in the press around this figure.

The Financial Times reported HSBC have reiterated that it would “keep its headquarters in the city, a decision that the bank arrived at after a 10-month review ending in February.” However whilst HQ will stay put it seems some roles would be affected…. Amber Choudhury at Bloomberg reported “Stuart Gulliver of HSBC Holdings Plc has said the lender would likely need to move 1,000 investment bankers to Paris because they’re linked to operations governed by MiFID II”

The BBC quoted Barclays CEO Jes Staley as saying that the bank is “staying anchored in Great Britain.”

Financial Services firms have been downsizing before Brexit. Cutting jobs and Offshoring jobs to Asia, Africa and Eastern Europe. Only last year Deutsche CEO John Cryan reported in the FT that he would withdraw from 10 countries and cut 9,000 jobs as part of an overhaul designed to restore profits….Lloyds boss Antonio Horta-Osorio has moved 7300 jobs and has another 1800 to go.

Relocating jobs – whats the impact on Audit?

Off to sunny Madrid?…

Auditors who think a move to Madrid, Dublin or Frankfurt (for the record, some passporting and trading licences are already in place in Frankfurt at some banks), could be disappointed as salaries will align to the local market. So a senior VP on a £120k salary is not likely to attract anything near that elsewhere in Europe, but then the cost of living and other outgoings are lower.

Some reports have gone as far to say VP’s should expect to lose as much as half of their salary if their role is relocated. However I don’t see this analysis applying to the Senior Auditor as it doesn’t take into account the premium required to attract those with the rare skills and knowledge of complex markets that the UK FS Auditor possesses. Infact Audit, Legal, Controls & Risk staff could be in high demand to help manage change during Brexit.

Research from consultancy Synechron concludes that it costs an average of £50k per employee in relocation costs to move employees to either Amsterdam, Frankfurt, Paris or Dublin.

Relocating roles doesn’t present the cost saving you might expect, certainly in the short term.

One senior individual I spoke to is not expecting to relocate but has seen an increase in travel to local branches and an increase in regional hiring within overseas offices at junior levels. He expects “no significant changes until there is more clarity around passporting” [see – Brexit internal audit job market within financial]. Furthermore, “a limited amount of roles around operations and functions are expected to move ” but this is just another symptom of the cost savings that banks have been going through. Brexit is just one more difficulty to deal with as [my employer] seeks to save costs by offshoring. Change always creates work for governance and controls. It’s just more of the same with Brexit”.

Company News: Salaries & Market Reports

Brexit: Internal Audit Job Market within Financial Services

Uncertainty… well yes, the big questions concern Mifid II and passporting issues.

Of the audit professionals I’ve talked to those within branches of mid-cap overseas banks are the most worried. The feeling in large cap Banks and Asset Managers is pretty much “wait and see”. Dare I say that this might be because the big banks were just not prepared? Steve Slater at Reuters reported a few weeks ago “Banking trade bodies said they are holding “non-stop meetings” to discuss the issue. Banks had lined up contingency plans, but some were half-hearted and few banks expected to use them, sources said.”

So this means lots of work for Legal, Controls & Risk staff right?

Well if (and it’s a big if) passporting rights or an equivalent arrangement can be settled with the EU then the Auditors I speak to feel it should be back to business as usual with a string of work for Audit, Accounting, Risk, Controls and Legal professionals.

What of Mifid II – the EU directive that covers everything from bond trading to Hedge funds? Again, Auditors I’ve spoken to have not changed course and expect Mifid II implementation to forge ahead in time for the go live date of Jan 2018.

How has this affected confidence in the Audit job market?

I’ve already seen an Increase in Internal Audit vacancies compared to this time last year especially at the AVP level from Banks with a significant weighting in the UK. We’ve also noticed some financial services houses have lifted previous recruitment freezes.

However, on the flip side with this increase in cost, pay and bonuses are likely to be affected.

Bonuses

The sentiment is that London bonuses are likely to decrease this year and unfortunately for those staff at European banks it’s compounded, as any deferred bonuses will see their value fall sharply.

I’ll post again in the coming days on what jobs will be affected by Brexit and what this means for EU passport holders.

Company News: Salaries & Market Reports

Company News: Salaries & Market Reports

Fleet internal audit salary and market report 2015

Welcome to the latest Fleet Market report covering salarys and market news for financial services and banking audit 2015. The post below is taken from our pdf report. For the full pdf version of the report please click here.

Welcome to the latest Fleet Market report covering salarys and market news for financial services and banking audit 2015. The post below is taken from our pdf report. For the full pdf version of the report please click here.

Contents

Market Overview

Vacancy Trends

Factors Affecting Career moves

Salaries

Market Overview

“volume of vacancies has increased”

The London Financial Services Audit market strengthened over the course of 2014 with the volume of vacancies increasing since autumn of 2013. Risk and Corporate Governance have continued to be a strong market as has Sales and Trading Audit. We have also seen a resurgence of vacancies within the IT Audit space. As the economic climate recovers at a slower pace than originally predicted, there are still considerable consultancy and contract work opportunities (see fig1) with the split remaining similar to last year. However, organisations are seeking to reduce contract hire costs in the long term by hiring on a permanent basis where possible.

Perhaps unsurprisingly, given the prevalence of fines being levied in financial services there have been some instances of large scale redundancies but for the most part, Internal Audit has not been affected. Audit vacancies for some particularly sought after skill sets have increased:

Perhaps unsurprisingly, given the prevalence of fines being levied in financial services there have been some instances of large scale redundancies but for the most part, Internal Audit has not been affected. Audit vacancies for some particularly sought after skill sets have increased:

• Global Markets (Associate and AVP)

• Risk – Market, Credit and Model

• Regulatory and Compliance

• IT Audit – Applications and Infrastructure

• Finance & Treasury

Vacancy Trends

“shortage of recently qualified Chartered Accountants”

CAPITAL MARKETS AUDIT

Sales and Trading Audit remains consistent in its need for strong candidates. Roles in Risk and Models Audit groups were required by most firms during 2014. There has been an increased demand for Auditors with strong knowledge across Fixed Income, FX and Equities asset classes and related functional areas. Overall, banks are gearing up for significant junior level recruitment in the coming year due to the shortage of recently qualified Chartered Accountants.

It is likely that 2015 will be the year that the legacy of the hiring freezes of 2009 – 2011 begins to bite. The resulting scarcity of qualified and experienced junior hires from traditional sources like Big4 firms will have a considerable impact on how Audit functions seek to fill this gap in the coming year. Possible trends include:

• Relaxing selection criteria

• Seeking ‘equivalent qualified’ candidates within Europe

• Utilising consultants and contractors

• Increasing senior hires

• Outsource junior Audit to risk and control consultancies

IT AUDIT

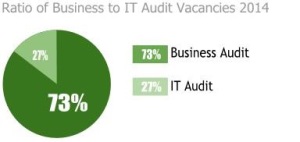

Technology Audit saw a resurgence during 2013 with an increase in mid and senior level IT Audit vacancies. During 2014 there was an increase in the number of junior hires compared to operational audit roles (see fig 2) and we believe this is going to continue into 2015. Most organisations are seeking technology auditors for capital markets applications roles and some infrastructure requirements at mid level.

RISK AND MODELS AUDIT

Regulatory developments continue to drive the need for risk professionals at all levels. As regulatory bodies continue to levy fines and redress underlying causes of the crash of 2008, Risk and Models Audit functions continue to require strong, highly qualified subject matter experts ideally with Audit experience. However, given the shortage of Auditors possessing specific risk experience, most firms have been looking for risk and models practitioners with the ability to understand process risk and control.

FUNCTIONS AUDIT

There has been an increase in the number of houses seeking well qualified senior level auditors with enterprise level controls and risk experience of multiple functional areas particularly COO and governance.

ASSET MANAGEMENT & PRIVATE BANKING AUDIT

Vacancies in asset management have remained consistent for junior and mid level roles with a few new senior Director level opportunities at smaller asset management boutiques. In 2015 we expect recruitment for the first six months will continue to focus on junior and mid level hires. Recruitment patterns during the latter part of 2015 are likely to be influenced in part by the implementation deadline of UCITS V in March 2016.

Whilst front office Wealth Management firms have scaled back in the UK and increased the bar for portfolio levels expected of new hires, there has been a welcome return of senior roles in Asia. We envisage as need for Auditors at the junior to mid levels.

Factors Affecting Career Moves

For this section join our Linkedin group – Audit Professionals Career Network – Financial Services – it’s free for members!

Salary Guide**

For this section of the report join our Linkedin group – Audit Professionals Career Network – Financial Services – it’s free for members!

This report and further information can be found at http://www.fleet-search.com. For more detailed analysis please contact Fatima Luna & Ketan Gohil on 0845 500 5155 or email [email protected].

Fleet search and selection Ltd is a professional recruitment consultancy in the financial services industry. Fleet specialise in contingency and executive search for the internal audit, wealth management, and technology sectors, with offices in London and Edinburgh.

LONDON

Fleet Search & Selection London

Token House,

11/12 Tokenhouse Yard,

London, EC2R 7AS

Main: 0845 500 5155

Mobile friendly: 0207 099 7180

Fax: 0845 527 1947

[email protected]

EDINBURGH

Fleet Search & Selection Edinburgh

The Bourse

47 Timberbush

Edinburgh

EH6 6QH

Main: 0845 500 5155

Mobile friendly: 0131 564 0050

Fax: 0845 527 1947

[email protected]

© Fleet Search and Selection Ltd, 2015. For requests to use this copyright-protected work in any manner, email [email protected] or call 0845 5005155.

Company News: Salaries & Market Reports

Are we there yet? Diversity, Inclusion and the Workplace

Tim Cook, Apple’s CEO came out as gay in a public essay for Bloomberg in October of 2014. Here in the UK, Lord Davies’ review of Women on Boards is well in to its third year. Vince Cable is to announce a similar target for ethnic minority representation at Board Level. More than a decade after the EU Commission launched their information campaign ‘For Diversity. Against Discrimination’, the fact that diversity in the workplace is good for business is a hot topic.

Tim Cook, Apple’s CEO came out as gay in a public essay for Bloomberg in October of 2014. Here in the UK, Lord Davies’ review of Women on Boards is well in to its third year. Vince Cable is to announce a similar target for ethnic minority representation at Board Level. More than a decade after the EU Commission launched their information campaign ‘For Diversity. Against Discrimination’, the fact that diversity in the workplace is good for business is a hot topic.

In January 2013, the Department for Business and Innovation published their survey of academic literature on the Business Case for Equality and Diversity aiming to provide a comprehensive review of the economic evidence of its benefits. As of 2012, over 5,500 businesses in 12 EU countries had voluntarily signed up to EU Diversity Charters. Opportunity Now, the UK campaign to improve gender inequality in the workplace reported in their Benchmarking Trends Analysis report of 2010 – 2011 that 96% of employers had a Diversity and Inclusion champion at board level. Business leaders interviewed for the EU’s 2014 Assessing Diversity: Impact on Business reported that not only did a diverse and inclusive workplaces have a positive impact on company culture; it improved their business position in the market. It would seem that business leaders and employers are committed to creating a workplace that reflects the diversity found in their customer base.

Despite the high profile announcements and the statistics, it takes very little effort to find a wealth of depressing stores about discrimination in the workplace today: high levels of unemployment amongst the disabled and the young ; over a quarter of the LGBT community are not fully open about their sexuality at work; Boards of Directors that are predominantly white and male; high levels of name based discrimination against ethnic minorities in the recruitment process; and the rise of discrimination against pregnant women at work. All these stories paint a very different picture about the day-to-day realities of diversity in the workplace. Is it any wonder that nearly half of UK workers surveyed for Adecco Group’s ‘Unlocking Britain’s Potential’ campaign dismissed their employer’s diversity policies as little more than a PR stunt?

While there is still some way to go before the world of business reflects the diversity found across the globe, it is unfair to unilaterally dismiss all diversity policies as another example of spin doctoring. The French bank BNP Paribas listed discrimination as one of its top 30 operational risks in 2006. Tier one banks and Big4 firms routinely make the top employers lists for women and the LGBT community as well as gaining recognition in the Disability Standard and Race For Opportunity awards. Deutsche Bank launched ‘Born to be’ a youth engagement programme in 2013, aimed at tackling youth unemployment through early intervention. All these initiatives do count for something, however small the changes they effect may seem. The movements to ensure universal suffrage, the right to vote regardless of class, gender, ethnicity or ability, began over a century ago and there are still active movements across the globe today. The road to a truly diverse and inclusive workplace may be just as long and we should celebrate its pioneers.

© 2014 Jane Christie

Company News: Salaries & Market Reports

Why on earth would anyone change jobs in autumn?

In Financial Services, many people believe that the best time to start looking for a new role is in the late spring; once budgets have been set and bonuses awarded. While the period of April to June is the peak time of year for recruitment, September to early December is also a very busy time.

In Financial Services, many people believe that the best time to start looking for a new role is in the late spring; once budgets have been set and bonuses awarded. While the period of April to June is the peak time of year for recruitment, September to early December is also a very busy time.

In some ways, actively searching for a new role in the autumn seems foolhardy in the extreme as it would mean walking away any discretionary bonus. Why anyone would do more than keep a vague eye on job boards when management are just beginning to think about discussing bonus awards, doesn’t seem to make any sense. That is, of course, unless your role is making you miserable, you’re fed up working in the industry or personal circumstances dictate. For those who are just a teensy bit bored with the routine of their job, how can walking away from a bonus be logical? It’s no secret that bonuses aren’t what they used to be and regulators are working to ensure that they never will be again. As such, are there any reasonable arguments for putting yourself forward for that perfect role you stumble upon in October?

Fewer Competitors

One simple reason to search for a new role in the autumn is that many of the direct competitors for the role are of the opinion that walking away from a discretionary bonus in the eleventh hour is on a par with a chocolate teapot in the practicality stakes. However, having fewer competitors for the role does mean that the odds are in favour of the job seeker rather than the employer.

Rewards as Golden Handcuffs

Adaptive performance formation is a term psychologists use to describe what happens when your priorities shift as contexts evolve. Once you have received your ‘reward’, as described in the Skinner Experiment, you are more inclined to look favourably on a given situation. In plain English, once you have been given a bonus, any issues you may have had with your role seem less of a problem than they were before. If this rings bells, perhaps it is time to think about changing roles based on the calendar related decisions rather than how your performance is rewarded. Sam Polk, a former Wall Street Hedge Funder, walked away from his lucrative career after realising he was addicted to making money. While the example his experience provides is admittedly an extreme one, his description of feeling trapped and miserable provides an excellent foil for anyone who is holding back from actively searching for another role because of things like salary and benefits packages.

Golden Hellos from a new employer

Perhaps the most important factor to consider is the Golden Hello. Professions including teaching, medicine and the TA, all subscribe to it as does the Financial Services Industry. News like UBS’s golden hello to Andrea Orcel can make the practice seem like the exclusive reserve of C Suite Executives, however, sign on bonuses are also offered at senior manager level. Hiring managers and HR are all well aware that any new staff taking up a post in the autumn will miss out on a bonus from their previous employer. Most of them are expecting to compensate them for their loss. Applying for a new role in October does not mean abandoning all hope of receiving a bonus for that year. Rather, candidates should be prepared to discuss all aspects of their salary and benefits package, including work/life balance benefits, with their prospective employer.

©Jane Christie 2014

Company News: Salaries & Market Reports

What’s in a Job Title?

As far as job titles go, the Director of Tax Education and Enlightenment has a certain ring to it. It sounds like the sort of role that demands in depth knowledge of the works of Voltaire alongside every tax system the world over. Far from being a made up job title, this role exists with responsibilities, reporting lines and a salary to go with it. Besides providing a nearly inexhaustible means of starting conversations at conferences and dinner parties, does a job title mean anything at all to your career? Many of us see job titles as providing easily understandable reference points when mapping out our future careers. If I want to retire as the Director of Tax Education and Enlightenment, then I will need to progress up the career ladder in a steady fashion and job titles will help me decide which roles will take me where I want to go. Or will it? Facile though this question may seem, job titles and their importance are issues that come up time and time again in recruitment.

Little wonder why this issue muddies the waters as it does. These days, you can find genuine vacancies advertising roles such as: Sandwich Artist, JavaScript Ninja or Chief Creative Enlightened Officer. The Economist refers to this phenomenon as panflation and while historically American companies were more likely to have” Directors of First Impressions” manning the reception desk, more and more UK and European companies are succumbing to panflation’s allure. After all, creating a fancy job title costs much less than pay rises or promotions and if that keeps staff happy, so much the better. Between 2005 – 2009 Linkedin members with Vice President in their title grew 426% faster than membership overall.

Surely employers up-titling a job is a problem for the employer not the job seeker? Most of us are savvy enough to realise a Vice President in a three person start-up company won’t have anything like the same responsibilities as a Vice President in a company with 300 employees. The glut of titles like Vice President in the market makes it difficult to learn what the going rate for someone with your particular background should be. If you are someone who wants to retire as a Chief Risk Officer of a tier 1 bank, what kinds of roles should you be considering next? Vice President? Assistant Vice President? Manager? Although job titles may roughly translate across an industry, the internal hierarchy of businesses will be influenced by the size and focus of that organisation. A smaller, boutique firm is unlikely to have the same tiered internal hierarchy as that of a multinational company – what looks like a horizontal move on paper isn’t necessarily a career dead end.

To paraphrase CBS’ Evil HR Lady: a job title is irrelevant, what matters is what the role does. Titles provide scant detail on the sum of responsibilities that fall under that role. Anyone external to the company will not be able to tell at first glance whether a Director of Tax Education and Enlightenment is how that company refers to its Tax Advisory Service or whether it is the title for a Senior Trainer in Learning and Development. By shifting the focus of attention to the responsibilities of the role, you will get a much clearer picture of where the role can take you and whether it is the right one for you. Moving from a Vice President role in one company to an Associate role in another may seem like a retrograde step, but by taking in to consideration the content of the role and the culture of the organisation you may find that the Associate role provides the crucial experience you need to fast track your career.

©2014 Jane Christie

Vacancies

- Risk Analyst12 02 2025

- Controls/Assurance Manager16 01 2025

- Global Head of Internal Audit – Compliance and Financial Crime04 11 2024

- Lead Auditor28 08 2024

- Associate Director / Senior Structural Engineer – Scotland – Inverness, Argyle, other highland locations also considered!28 08 2024