Company News: Financial Market News

German and British Regulators Examining Deutsche Bank’s Controls and Reporting

German and British regulators are examining Deutsche Bank’s systems and controls as questions have again arisen about the German lender’s reporting procedures. . .

Company News: Financial Market News

FRC to focus on company culture and behaviour in 2015

The Financial Reporting Council (FRC) has noted many improvements in its recent report on compliance with UK Corporate Governance Code and increasing numbers of signatories to the Stewardship Code, however there are still areas for improvement, it warns . . .

http://auditandrisk.org.uk/news/frc-to-focus-on-company-culture-and-behaviour-in-2015

Company News: Financial Market News

Fleet internal audit salary and market report 2015

Welcome to the latest Fleet Market report covering salarys and market news for financial services and banking audit 2015. The post below is taken from our pdf report. For the full pdf version of the report please click here.

Welcome to the latest Fleet Market report covering salarys and market news for financial services and banking audit 2015. The post below is taken from our pdf report. For the full pdf version of the report please click here.

Contents

Market Overview

Vacancy Trends

Factors Affecting Career moves

Salaries

Market Overview

“volume of vacancies has increased”

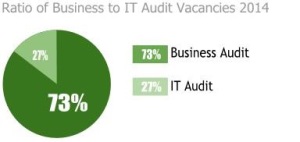

The London Financial Services Audit market strengthened over the course of 2014 with the volume of vacancies increasing since autumn of 2013. Risk and Corporate Governance have continued to be a strong market as has Sales and Trading Audit. We have also seen a resurgence of vacancies within the IT Audit space. As the economic climate recovers at a slower pace than originally predicted, there are still considerable consultancy and contract work opportunities (see fig1) with the split remaining similar to last year. However, organisations are seeking to reduce contract hire costs in the long term by hiring on a permanent basis where possible.

Perhaps unsurprisingly, given the prevalence of fines being levied in financial services there have been some instances of large scale redundancies but for the most part, Internal Audit has not been affected. Audit vacancies for some particularly sought after skill sets have increased:

Perhaps unsurprisingly, given the prevalence of fines being levied in financial services there have been some instances of large scale redundancies but for the most part, Internal Audit has not been affected. Audit vacancies for some particularly sought after skill sets have increased:

• Global Markets (Associate and AVP)

• Risk – Market, Credit and Model

• Regulatory and Compliance

• IT Audit – Applications and Infrastructure

• Finance & Treasury

Vacancy Trends

“shortage of recently qualified Chartered Accountants”

CAPITAL MARKETS AUDIT

Sales and Trading Audit remains consistent in its need for strong candidates. Roles in Risk and Models Audit groups were required by most firms during 2014. There has been an increased demand for Auditors with strong knowledge across Fixed Income, FX and Equities asset classes and related functional areas. Overall, banks are gearing up for significant junior level recruitment in the coming year due to the shortage of recently qualified Chartered Accountants.

It is likely that 2015 will be the year that the legacy of the hiring freezes of 2009 – 2011 begins to bite. The resulting scarcity of qualified and experienced junior hires from traditional sources like Big4 firms will have a considerable impact on how Audit functions seek to fill this gap in the coming year. Possible trends include:

• Relaxing selection criteria

• Seeking ‘equivalent qualified’ candidates within Europe

• Utilising consultants and contractors

• Increasing senior hires

• Outsource junior Audit to risk and control consultancies

IT AUDIT

Technology Audit saw a resurgence during 2013 with an increase in mid and senior level IT Audit vacancies. During 2014 there was an increase in the number of junior hires compared to operational audit roles (see fig 2) and we believe this is going to continue into 2015. Most organisations are seeking technology auditors for capital markets applications roles and some infrastructure requirements at mid level.

RISK AND MODELS AUDIT

Regulatory developments continue to drive the need for risk professionals at all levels. As regulatory bodies continue to levy fines and redress underlying causes of the crash of 2008, Risk and Models Audit functions continue to require strong, highly qualified subject matter experts ideally with Audit experience. However, given the shortage of Auditors possessing specific risk experience, most firms have been looking for risk and models practitioners with the ability to understand process risk and control.

FUNCTIONS AUDIT

There has been an increase in the number of houses seeking well qualified senior level auditors with enterprise level controls and risk experience of multiple functional areas particularly COO and governance.

ASSET MANAGEMENT & PRIVATE BANKING AUDIT

Vacancies in asset management have remained consistent for junior and mid level roles with a few new senior Director level opportunities at smaller asset management boutiques. In 2015 we expect recruitment for the first six months will continue to focus on junior and mid level hires. Recruitment patterns during the latter part of 2015 are likely to be influenced in part by the implementation deadline of UCITS V in March 2016.

Whilst front office Wealth Management firms have scaled back in the UK and increased the bar for portfolio levels expected of new hires, there has been a welcome return of senior roles in Asia. We envisage as need for Auditors at the junior to mid levels.

Factors Affecting Career Moves

For this section join our Linkedin group – Audit Professionals Career Network – Financial Services – it’s free for members!

Salary Guide**

For this section of the report join our Linkedin group – Audit Professionals Career Network – Financial Services – it’s free for members!

This report and further information can be found at http://www.fleet-search.com. For more detailed analysis please contact Fatima Luna & Ketan Gohil on 0845 500 5155 or email [email protected].

Fleet search and selection Ltd is a professional recruitment consultancy in the financial services industry. Fleet specialise in contingency and executive search for the internal audit, wealth management, and technology sectors, with offices in London and Edinburgh.

LONDON

Fleet Search & Selection London

Token House,

11/12 Tokenhouse Yard,

London, EC2R 7AS

Main: 0845 500 5155

Mobile friendly: 0207 099 7180

Fax: 0845 527 1947

[email protected]

EDINBURGH

Fleet Search & Selection Edinburgh

The Bourse

47 Timberbush

Edinburgh

EH6 6QH

Main: 0845 500 5155

Mobile friendly: 0131 564 0050

Fax: 0845 527 1947

[email protected]

© Fleet Search and Selection Ltd, 2015. For requests to use this copyright-protected work in any manner, email [email protected] or call 0845 5005155.

Company News: Financial Market News

Goldman Said to Award Blankfein $24 Million in Stock, Cash

Goldman Sachs Group Inc. awarded Chief Executive Officer Lloyd C. Blankfein $24 million in salary and cash and stock bonuses for 2014, according to a person familiar with the matter.

Company News: Financial Market News

Gorman at Morgan Stanley to Receive $4.4 Million Stock Bonus

Morgan Stanley’s chief executive, James Gorman, is receiving a $4.4 million stock bonus for 2014 in addition to his $1.5 million salary. . .

Company News: Financial Market News

EBA says impact of liquidity coverage requirements for EU banks not likely to have adverse effects

The European Banking Authority (EBA) published today its impact assessment report for liquidity coverage requirements. Overall, this analysis points to improvements of EU banks’ compliance with Liquidity Coverage Ratio (LCR) requirements and shows that the implementation of the LCR is not likely to have a negative impact on the stability of financial markets and of the supply of bank lending. The report is based on liquidity data provided by 322 European banks, covering about 2/3 of total banking assets in the EU, and it will inform EU policies aimed at strengthening the resilience of EU banks . . .

Company News: Financial Market News

Second progress report on banks’ adoption of risk data aggregation principles issued by the Basel Committee

The Basel Committee on Banking Supervision today issued a second progress report on banks’ adoption of the Committee’sPrinciples for effective risk data aggregation and risk reporting. Published in 2013, the Principles aim to strengthen risk data aggregation and risk reporting at banks to improve their risk management practices and decision-making processes. Firms designated as global systemically important banks (G-SIBs) are required to implement the Principles in full by 2016. . .

Company News: Financial Market News

Goldman Sachs Pay Ratio Slips to Second-Lowest Level Since IPO

he portion of revenue Goldman Sachs Group Inc. set aside last year to pay employees was the second-lowest since it became a public company, as the bank grapples with a trading slump.

http://www.bloomberg.com/news/

Company News: Financial Market News

UK’s top companies failing to provide clear measures of ethical standards, warns IIA

While many FTSE100 companies say they operate ethically, very few offer clear measures to prove this, according to a new IIA study. . .

Company News: Financial Market News

EBA says impact of liquidity coverage requirements for EU banks not likely to have adverse effects

The European Banking Authority published today its impact assessment report for liquidity coverage requirements. Overall, this analysis points to improvements of EU banks’ compliance with Liquidity Coverage Ratio (LCR) requirements and shows that the implementation of the LCR is not likely to have a negative impact on the stability of financial markets and of the supply of bank lending. The report is based on liquidity data provided by 322 European banks, covering about 2/3 of total banking assets in the EU, and it will inform EU policies aimed at strengthening the resilience of EU banks.

Vacancies

- Compliance and Risk Manager – Work from home20 03 2024

- Compliance Testing Manager – Part Time – Work from home28 02 2024

- Internal Audit Manager – Small Branch of Global Bank, London11 12 2023

- Internal Audit Manager / No2 – Small Branch of Global Bank, London21 11 2023

- Internal Audit – Great Small Team Environment, Global Firm, London02 10 2023